What is financial literacy?

Financial literacy is the ability to understand and effectively use financial skills, such as personal financial management, budgeting, and investing. In the world of investments and creating wealth through multi-channels, merely possessing money is not enough to make it sustainable. Financial literacy for women is thus very important to keep track of finances.

Financial literacy is the foundation of your relationship with money, and it is a lifelong journey of learning. The earlier you start, the better off you will be because education and its application are the keys to success when it comes to money.

Both women and men should acquire financial knowledge to participate in money-related issues of their families effectively. But it has been observed that women in India have limited financial knowledge. This could be on account of women traditionally being ‘home-makers’ and not being concerned with where the finances are coming from and where they should go. However, with the changing economic scenario and the higher participation of women in the workforce, financial literacy for women should be given topmost priority.

Women and financial literacy

Financial literacy for women is an important aspect of their independence, financial and otherwise. Being financially illiterate can lead to a number of problems. You could be more likely to accumulate debt burdens, have poor spending habits, or lack long-term preparation. Financial literacy empowers people, especially women, to make independent decisions. During emergencies or unforeseen circumstances, an individual can take correct steps if she is financially literate.

A survey revealed that only a small percentage of women are able to build on and grow their existing wealth. Among those, only about 33 per cent, have the confidence to invest their money as they see fit. Given that women’s roles in the domestic and public sphere are on the rise, these low figures show that financial literacy for women is still not part of mainstream discourse.

Why do women need financial literacy?

This is due to the following reasons:

- It prepares them for emergencies.

- Women can help deal with rising costs of living and inflation if they are financially literate.

- Children tend to be more influenced by their mothers than their fathers. Being financially literate sets a good example for your children as well.

- In most households, women are responsible for the day-to-day expenses. Thus, it is helpful for them to know how best to use the money.

- Women tend to live longer than men, and thus they should have the knowledge to carry on their day-to-day affairs and manage finances.

- Women who are financially literate gain more confidence in their own decision-making.

Prioritise financial independence

Financial literacy and women’s empowerment go hand in hand. Increasing your financial literacy can help you achieve your life and career goals more effectively. Financial independence serves as a cushion during unforeseen circumstances. Some studies show that women are often unable to leave abusive family situations or marriages due to financial dependency. Even for women who have careers, often their income is seen as just extra income and they are expected to take up additional responsibilities at home as well.

All the genders should gain financial literacy so that they can share responsibilities as well as make best use of their financial independence. Experts believe that knowing about financial literacy and actually implementing it in your life are very different things.

How can women gain financial literacy?

In this day and age, there are ample resources for women who wish to become financially literate. Online resources are abundant for those who wish to educate themselves. At the same, it is a stark reality that women in India may not always have the access to or know-how of the Internet to learn these things by themselves.

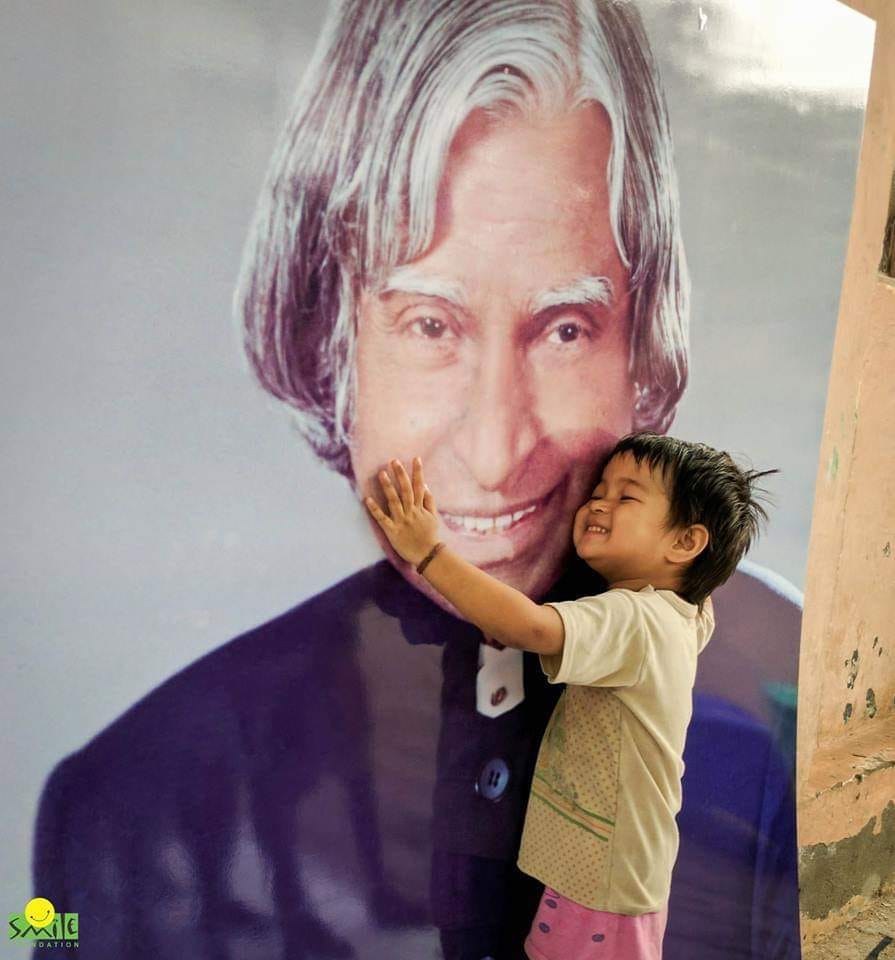

In such cases, self-help groups and organisations such as Smile Foundation can step in. For instance, the Swabhiman project, aimed at women’s empowerment, recently conducted a session on financial literacy. The session was held with 70 women in Guttahali, Bengaluru.

Sessions like the one mentioned above has the potential of bringing in people together with the same life-building aspirations. Financial literacy then becomes a process of learning through text books, experts and people with valuable experience of managing money in their own lives.

Financial literacy leads to financial independence and mindful expenditure– both essential for a higher quality of living.

One reply on “The Importance of Financial Literacy for Women”

Liked very much