Women’s empowerment through economic education can help achieve gender equality and foster societal growth. In today’s world, where financial independence is a cornerstone of personal freedom, it is essential to equip women with the knowledge and tools they need to manage their finances effectively. Let’s understand the significance of economic education for women, the current state of financial literacy among women, and the potential impact of empowering women through economic education.

The Importance of Economic Education for Women

Economic education is not just about teaching women how to manage their money. It encompasses a broad spectrum of skills, including budgeting, investing, understanding credit and planning for retirement. Financial literacy supports women in making informed decisions about their lives, from choosing a career to managing a household.

Such an education empowers women by giving them the confidence to navigate financial challenges and seize opportunities. This empowerment leads to greater financial independence, which in turn enhances their ability to support themselves and their families. Moreover, economically empowered women can contribute more significantly to the economy, driving growth and innovation.

Current State of Financial Literacy Among Women

Despite the importance of financial literacy, many women still lack basic economic education. According to a survey highlighted in Livemint, 86% of working women are eager to improve their financial knowledge, indicating a significant gap in their current understanding. This gap can be attributed to various factors, including traditional gender roles, limited access to financial education and societal norms that discourage women from taking control of their finances.

The lack of financial literacy among women has far-reaching consequences. It can lead to poor financial decisions, increased debt and a lack of preparedness for retirement. Additionally, financially illiterate women may be more vulnerable to financial abuse and exploitation.

Initiatives to Promote Economic Education for Women

Various organisations and initiatives are working to bridge the financial literacy gap among women. Financial literacy programmes tailored specifically for women are being developed to address their unique needs and challenges. These programmes often include workshops, online courses and one-on-one coaching sessions.

For instance, some initiatives focus on teaching women about investment and wealth management, which are areas where women have traditionally been underrepresented. By providing women with the knowledge and confidence to invest, these programmes help them build wealth and secure their financial futures.

The Role of Technology in Economic Education

Technology plays a pivotal role in making economic education accessible to women. Online platforms and mobile applications offer financial education resources that women can access at their convenience. These tools provide interactive lessons, simulations and quizzes to enhance learning and retention.

Moreover, social media and online communities allow women to share experiences, ask questions and seek advice from peers and experts. This support network is invaluable for women who may feel isolated or intimidated by financial matters.

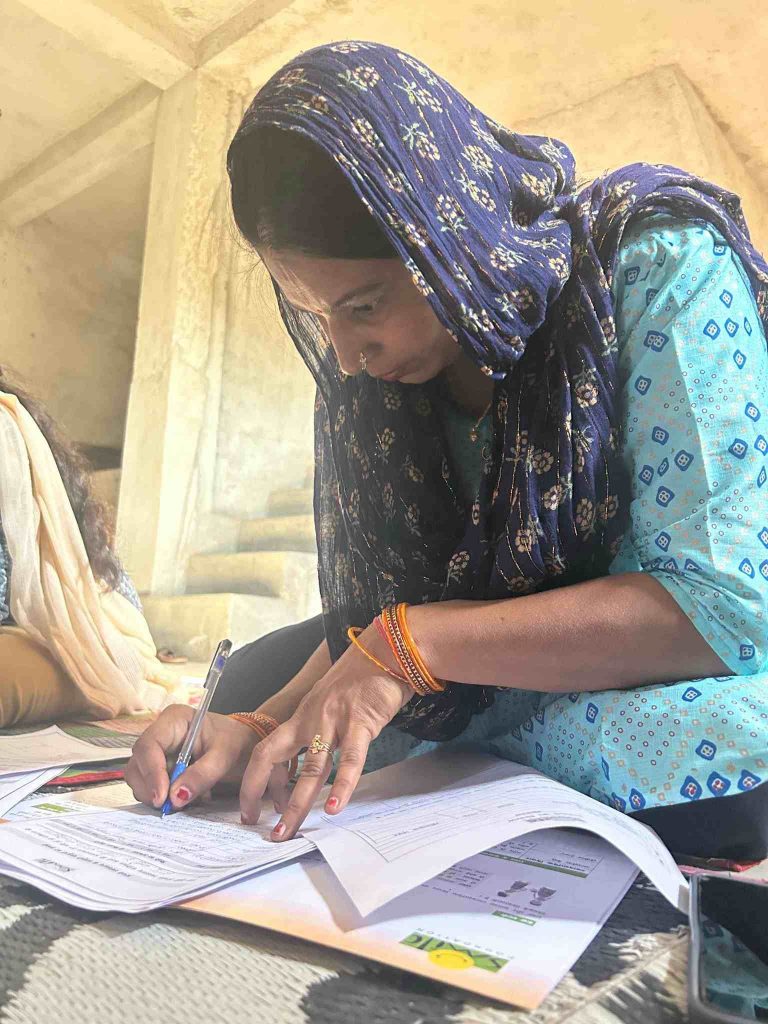

Case Study

Real-life success stories demonstrate the transformative power of economic education. For example, consider the story of Laxmi who started with a small investment in cosmetics and is now doing well in her business inspiring other women of her community to become independent and own their own small/big businesses.

This growth of Laxmi expanded her business after gaining financial knowledge. Through our women empowerment programme- Swabhiman, Laxmi learned about business financing, managing cash flow and strategic planning. Armed with this knowledge, she secured a loan to expand her business, increased her revenue and even created jobs in her community.

Barriers to Financial Literacy for Women

Several factors hinder women’s access to financial literacy. These include cultural norms that prioritise men’s financial education, lack of time due to caregiving responsibilities and limited access to financial resources. Additionally, many women may lack confidence in their financial abilities, further discouraging them from seeking education.

Strategies to Overcome Barriers

To overcome these barriers, inclusive and supportive learning environments for women are a must. Flexible learning options, such as online courses that women can complete at their own pace is one of those great learning options. Additionally, programmes should be designed to address the specific financial needs and challenges faced by women.

Mentorship and peer support encourage women to pursue financial education. By connecting women with mentors who can guide and support them, we can help build their confidence and competence in managing their finances.

The Impact of Financially Empowered Women on Society

Financially independent women are better equipped to leave abusive relationships, reducing the prevalence of domestic violence. Economic education thus plays a vital role in promoting gender equality and social justice.

Governments and policymakers have a critical role to play in promoting economic education for women. Policies should be implemented to ensure that financial education is included in school curricula from an early age. Additionally, public awareness campaigns can highlight the importance of financial literacy and encourage women to seek education.

Subsidies and incentives for financial education programs can also increase accessibility for women, particularly those from low-income backgrounds. By investing in women’s economic education, governments can foster a more equitable and prosperous society.

The Future of Economic Education for Women

The future of economic education for women looks promising, with increasing recognition of its importance and more resources being dedicated to this cause. As more women become financially literate, we can expect to see effects across society.

Financial education will continue to evolve, leveraging technology to reach more women and provide personalised learning experiences. With continued support from governments, organisations, and communities, we can ensure that all women have the opportunity to achieve financial independence and empowerment.

Empowering women through economic education is a powerful catalyst for change. By equipping women with the knowledge and skills they need to manage their finances, we can promote gender equality, drive economic growth and create a more just and equitable society.

The journey towards financial empowerment for women is ongoing, but with continued effort and dedication, we can achieve significant progress. Let us commit to supporting and advocating for economic education for women, ensuring that every woman has the opportunity to thrive financially.