Trust is the invisible infrastructure of every economy. It allows money to move, contracts to hold and cooperation to thrive. In patriarchal societies, however, trust is rarely neutral. It’s distributed along lines of gender, age and authority.

For generations, women — especially in rural or traditional communities—have been excluded from financial decision-making not because they lacked ability, but because they lacked trust. They were considered too naïve to manage money, too vulnerable to fraud or too dependent on men to participate in financial systems.

Digital payments, over the past decade, have started to erode this imbalance. What began as a convenience tool in urban India — UPI transfers, mobile wallets and QR codes has become a gateway to recognition and independence for millions of women in rural and semi-urban settings.

By enabling direct, traceable, and transparent transactions, digital payments are rebuilding trust from the ground up—between women and institutions, women and their families, and women and their own sense of agency.

From Cash to Confidence

In patriarchal settings, control over cash often translates to control over people. In many families, even if women earn, their wages are handed over to male relatives. Savings are hidden, decisions deferred and mobility restricted. Cash, while tangible, has also been a tool of control — subject to scrutiny, suspicion and sometimes even confiscation.

Digital payments alter this equation subtly but significantly. When money moves digitally into a woman’s account, wallet or app — it introduces a form of autonomy that is verifiable yet private. The transaction is visible to systems but not necessarily to gatekeepers within the household.

For example, under India’s direct benefit transfer (DBT) programmes, government subsidies ranging from maternal health incentives to LPG subsidies are deposited directly into women’s bank accounts. With Jan Dhan–Aadhaar–Mobile (JAM) integration, women no longer need an intermediary to access what is rightfully theirs.

This shift from cash to digital has done something extraordinary: it has made women financially visible without making them socially vulnerable.

One woman from Madhya Pradesh put it succinctly in a field interview:

“When money comes to my phone, my husband believes I have earned it. When it came in cash, it was always questioned.”

That is the confidence digital money builds — not just in technology, but in women themselves.

The Digital Handshake: How Technology Builds Credibility

At its core, every financial transaction is a handshake of trust. Traditional banking relied on physical signatures, paper trails and face-to-face validation. Digital systems replace those with authentication, passwords and identity verification.

For many women, especially those excluded from formal credit systems, this digital handshake is their first encounter with institutional trust.

Once a woman uses her fingerprint or OTP to authenticate a transaction, she establishes proof of reliability — a digital footprint that can be used to access credit, insurance or subsidies in the future. Her transactions create a record that speaks louder than social assumptions.

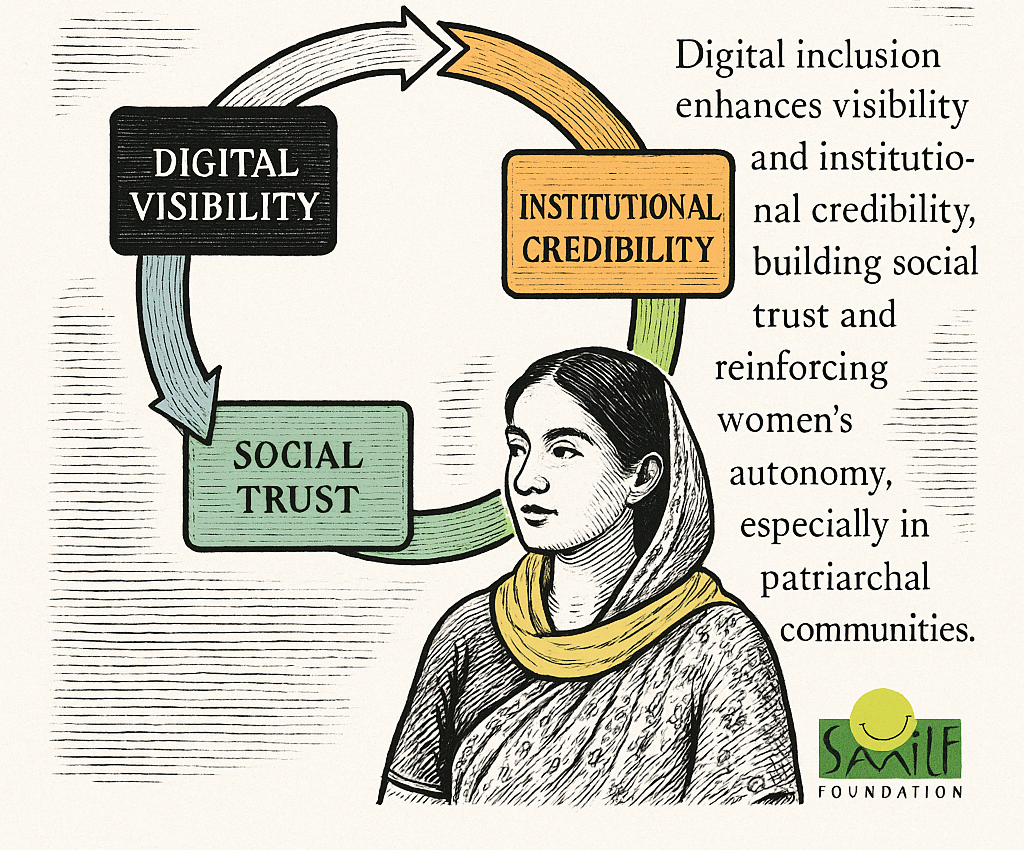

Over time, this visibility becomes power. When a woman receives payments regularly — say, wages from a self-help group activity or small business — she not only gains financial stability but also digital credibility. Banks and fintechs see her as a customer; communities begin to see her as capable.

The digital trail that was once feared as exposure becomes evidence of empowerment.

Patriarchy, Privacy and Perception

But transformation doesn’t happen overnight. In many patriarchal households, the introduction of digital finance initially triggered anxiety. Men worried about loss of control, elders about misuse and communities about “women going astray” online.

These concerns were not unfounded—they were reflections of a system built on surveillance rather than trust. When women began using mobile payments, patriarchal gatekeepers saw them as a threat to the social order rather than a step towards efficiency.

Yet over time, digital literacy has shifted perception. Once families realised that digital transactions are traceable, auditable, and often safer than cash, resistance softened.

Ironically, it is the transparency of digital systems — the same feature that once frightened traditional structures — that eventually made them acceptable. Fathers who once refused daughters permission to carry money now approve digital transfers for online courses or business purchases because “it can be tracked.”

Thus, digital payments have built a new kind of trust in patriarchal contexts — not blind trust, but measurable trust. And that distinction has made all the difference.

The Gender of Trust: Why Visibility Matters

Trust is gendered because society measures credibility differently for men and women. A man’s transaction history is assumed honest until proven otherwise; a woman’s credibility must be earned.

Digital payments help level this field by replacing subjective reputation with objective record. Whether it’s a QR code business on a street corner, a self-help group’s micro-enterprise or a woman selling produce online, digital payment receipts act as evidence of reliability.

In one village in Odisha, a women-led self-help group reported that after adopting QR-based payments for their tailoring services, male customers who once delayed cash payments started paying promptly. The reason was simple: once a digital trail existed, excuses disappeared.

The women, in turn, gained not just income but business credibility. They could now show transactions to apply for micro-loans or request inventory credit.

Visibility in finance leads to visibility in society. When a woman’s digital transactions show consistency, her standing in the community rises. She becomes not just a participant in the economy, but a proof of what trust looks like in action.

Smile Foundation’s Work: Technology as a Social Equaliser

In several of Smile Foundation’s women empowerment and livelihood programmes, the adoption of digital payments has become a turning point — not only for efficiency but for dignity.

Through initiatives under its Smile Twin e-Learning Programme (STeP) and community-based skill development projects, Smile Foundation integrates digital finance training into women’s livelihood journeys. Women who learn tailoring, beauty services or retail management are also trained to use UPI, mobile wallets and basic online banking tools.

The change is often psychological before it is economic. Many women participants begin by expressing fear of “spoiling the phone” or “pressing the wrong button.” Within weeks, they are confidently scanning QR codes, receiving payments and explaining the process to neighbours.

A coordinator in Smile’s Delhi centre shared:

“The first time a woman receives a digital payment directly to her account, her body language changes. It’s not just money—it’s validation.”

By embedding digital payments into its livelihood ecosystem, Smile Foundation is effectively creating a new template of trust — one where institutions trust women as account holders and women trust themselves as decision-makers.

Trust, Access and the Social Contract

Patriarchal societies operate on a deeply unequal social contract: men are trusted with control; women are trusted with compliance.

Digital financial inclusion challenges this contract by introducing a new, neutral arbiter of trust — technology.

A payment app doesn’t care about gender, caste or hierarchy. It validates identity and transaction objectively. This neutrality has subtle but profound effects:

- Equal access: Once a woman has a digital ID and a phone, she holds the same transactional power as anyone else.

- Traceability: Because digital payments leave an auditable trail, women can prove legitimacy without pleading for validation.

- Portability: A digital wallet travels with a woman wherever she goes—across markets, districts or jobs giving her mobility that patriarchy often denies.

In other words, technology replaces gatekeepers with systems. And systems, when designed well, democratise trust.

Case Snapshots: Trust in Transition

1. The self-help group in Jharkhand

In a small tribal district, a women’s self-help group (SHG) selling handicrafts shifted from cash to digital payments using a basic smartphone and QR code stickers. Initially, customers hesitated. But when one transaction went smoothly, word spread. Within three months, their sales doubled because men from nearby villages felt “safer” paying digitally.

The irony: the same digital trail that gave buyers confidence also gave women bargaining power.

2. The young entrepreneur in Uttar Pradesh

A 22-year-old woman running a home-based bakery began accepting UPI payments during the pandemic. Before that, her father managed her earnings. Now, she receives payments directly and tracks orders online. When relatives question her independence, she shows her digital ledger: “It’s all here, transparent.”

Her earnings haven’t just grown — they’ve become respectable in her family’s eyes.

3. The Anganwadi worker in Tamil Nadu

An Anganwadi worker trained under a Smile Foundation digital module started using her phone to record nutrition supplies and receive stipends. Over time, she began helping mothers in her community set up digital accounts. Trust in her grew — not only as a caregiver but as a financial guide.

These vignettes show that trust, once built digitally, often cascades socially.

The Double-edged Screen: Risks and Realities

Of course, digital trust is not without fragility. For every woman who gains control through technology, another risks exploitation through misinformation, scams or coercion.

Patriarchal communities often adapt to new systems by replicating old hierarchies in digital form — for instance, men taking control of women’s PINs or requiring phones to be shared.

Digital inclusion must therefore be accompanied by digital literacy. Women must not only know how to transact, but also why privacy, consent and verification matter.

Smile Foundation’s experience reinforces this: digital confidence grows fastest when training includes rights awareness, not just technical know-how. A woman who knows that “no one should ever ask for your OTP” learns to guard not only her money but her autonomy.

Trust, after all, depends on safety.

Why Trust precedes Empowerment

Development practitioners often assume empowerment leads to trust. In patriarchal societies, it’s often the reverse: trust enables empowerment.

A woman cannot exercise agency if her community doesn’t trust her with it. Digital payments create small but powerful spaces where that trust can be tested and proven.

Each successful transaction — each moment when a woman sends or receives money independently — adds a data point to her social credibility. Over time, those data points accumulate into legitimacy.

In that sense, digital payments function as micro-acts of empowerment. They don’t dismantle patriarchy overnight, but they chip away at its foundation by making women’s capability visible, measurable and undeniable.

The Psychology of Proof: Numbers Don’t Lie

Traditional gender norms often rely on invisibility: “We don’t see women earn, therefore they must not contribute.” Digital payments dismantle this invisibility by turning women’s labour into quantifiable evidence.

When a self-help group’s sales or a domestic worker’s wages appear as transaction records, society can no longer pretend women’s work is secondary. The psychology of proof becomes a lever for equality.

Even sceptical family members, who once doubted women’s earnings, begin to respect the digital trail. “She’s earning through proper channels” becomes a common phrase — a subtle but significant upgrade from suspicion to respect.

When daughters see their mothers using digital payments confidently, it normalises financial independence early. In several Smile Foundation communities, adolescent girls have started helping their mothers navigate apps — creating a reverse mentoring dynamic that softens patriarchal authority.

A girl who learns to manage digital money grows up expecting autonomy.

A mother who learns to trust herself financially raises daughters who are trusted from the start.

In this way, digital payments are not just building trust — they are redesigning inheritance, passing down confidence instead of compliance.

The Ecosystem Challenge: Beyond Technology

To sustain this transformation, digital payments must be supported by an ecosystem that reinforces trust. That includes:

- Financial institutions that treat women as primary clients, not dependents.

- CSR programmes that invest in digital and financial literacy as a continuum, not separate silos.

- Community facilitators who act as intermediaries of trust helping women navigate errors, fraud or confusion.

- Government initiatives that ensure grievance redressal mechanisms are accessible and gender-sensitive.

Smile Foundation’s integrated model combining education, health, livelihood and digital inclusion illustrates how trust thrives when technology is humanised. When a woman learns, earns and transacts within the same supportive ecosystem, her trust in the system (and herself) multiplies.

Measuring What Matters: The Trust Metric

How do we measure trust? It’s not captured in transaction counts or app downloads. True trust is reflected in behavioural shifts:

- Women making independent spending decisions.

- Families allowing women to handle household finances.

- Communities recognising women as credible economic actors.

Smile Foundation’s monitoring frameworks, for instance, often track “decision-making confidence” — a qualitative yet powerful indicator of empowerment. Over time, trust becomes not just a social outcome but a development metric as vital as literacy or income.

The Future of Trust is Inclusive

As India moves toward a cash-lite economy, digital payments are poised to become the default mode of financial interaction. But their true impact lies not in convenience, but in cultural transformation.

When technology mediates fairness, when transparency replaces bias and when data replaces doubt — trust becomes inclusive.

In patriarchal communities, this is revolutionary. It means that women no longer need to ask to be trusted; they can show they are trustworthy. It means that systems start reflecting equality long before society fully embraces it.

And it means that empowerment is no longer an abstract promise — it’s a transaction verified in real time.

Trust as the New Currency

Digital payments have done what decades of policy couldn’t fully achieve — they’ve made women visible in the economy, credible in their communities and confident in themselves.

In the language of finance, trust is the highest-value currency. When women control their digital transactions, they start accumulating that currency — bit by bit, day by day.

The real revolution is not in the transfer of money, but in the transfer of belief: belief that women can earn, decide and lead.

As one Smile Foundation facilitator said:

“Digital payments gave women something they never had—a record of trust.”

And in societies where trust has long been hoarded by men, that record might just be the beginning of balance.